Navigating the Impact of 2025 Tariffs on U.S. Businesses and Marketing Strategies

Author: Austin Wright, Head of Strategy & Analytics

The 2025 tariffs have created a ripple effect across the U.S. economy, impacting industries, consumer behavior, and marketing strategies. These tariffs, which include a 10% universal tariff and additional targeted measures on key trading partners, are reshaping the way businesses operate and how consumers spend their money.

The rapidly changing news around tariffs is fueling confusion and fatigue among consumers. Many are weary of policy shifts where today’s announcement is often reversed tomorrow, leaving them feeling disoriented and distrustful. Even as tariffs are paused, consumers continue to anticipate volatility, prompting more cautious and delayed spending behaviors.

At the same time, skepticism toward brands is growing; shoppers are closely watching whether companies fairly adjust pricing—or use uncertainty as an excuse to maintain higher costs. As a result, consumers are shopping with heightened scrutiny, conducting more research, hunting for deals, and prioritizing value over loyalty. This new climate of strategic, cautious spending is reshaping how brands must engage and build trust across every industry.

For marketers and CMOs, this new reality requires a deep understanding of how tariffs affect their industries—both directly and indirectly—and when those impacts will be felt. By anticipating these changes and adapting strategies accordingly, marketers can turn challenges into opportunities, ensuring their brands remain resilient in an uncertain economic environment.

Understanding the Impact of Tariffs

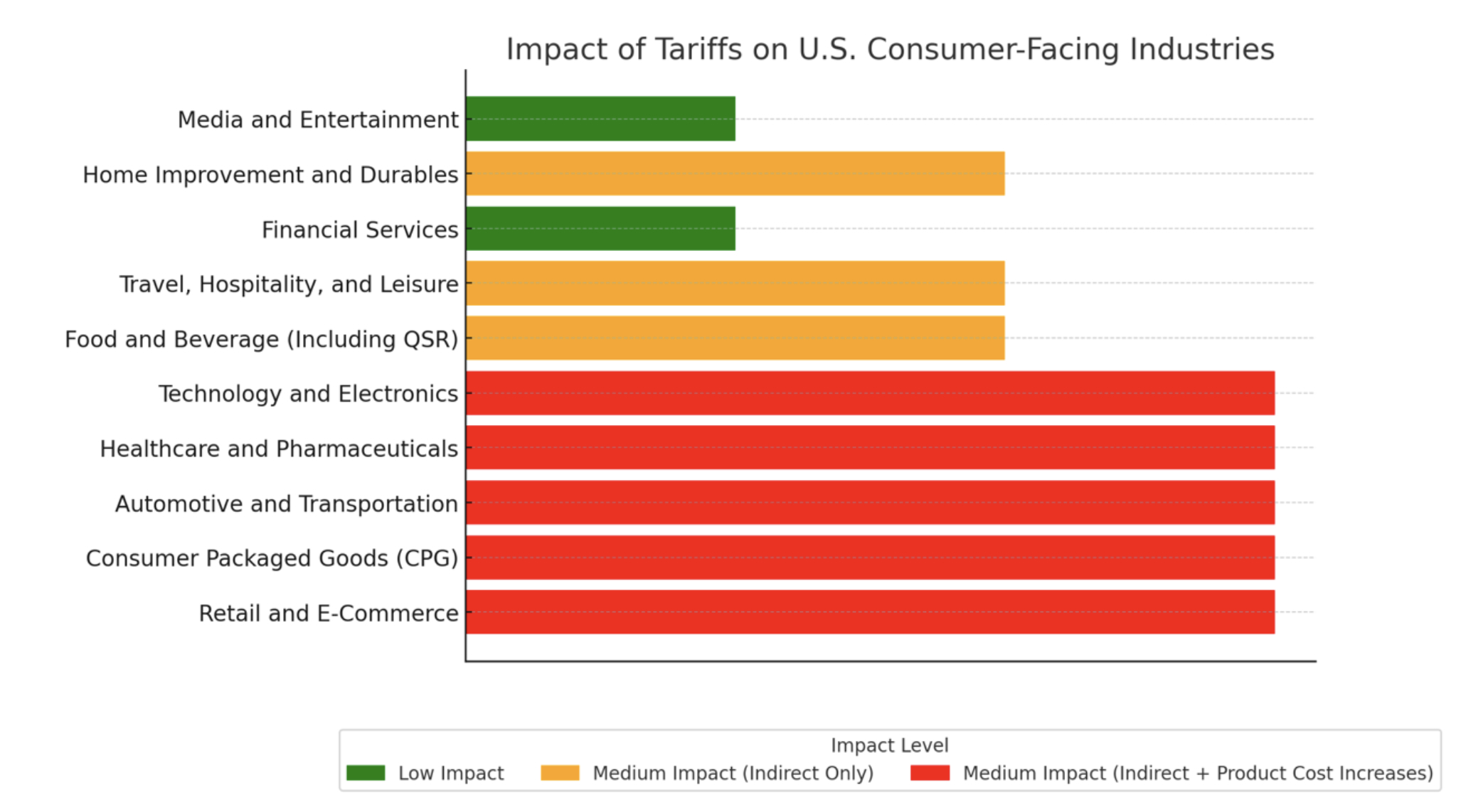

The effects of tariffs vary widely across industries. Some sectors face direct cost increases due to higher import tariffs on goods and materials, while others feel the indirect impact of inflation and reduced consumer spending. Timing also plays a critical role: certain industries experience immediate effects, while others will see delayed or long-term consequences as supply chains adjust and consumer behavior shifts.

Retail and E-Commerce

Retail is one of the industries most directly affected by tariffs. Higher costs for imported goods such as apparel, electronics, and home goods are already forcing retailers to make difficult decisions about pricing. These increases are expected to hit within the first four months as inventory turnover reveals higher costs. For e-commerce businesses, which often rely on global supply chains, the impact is equally significant. Marketers in this space must prepare for heightened price sensitivity among consumers while finding ways to maintain brand loyalty.

Consumer Packaged Goods (CPG)

The CPG industry faces both direct and indirect challenges from tariffs. Many products rely on imported raw materials such as oils, spices, and packaging components. These cost increases will likely be felt within the first few months as production cycles adjust to new realities. For marketers in this space, transparency about price changes and an emphasis on value will be critical in retaining customer trust.

Automotive and Transportation

The automotive industry is grappling with a 25% tariff on imported vehicles and parts—a measure that could disrupt supply chains worth $460 billion annually. While some manufacturers are absorbing costs temporarily or shifting production domestically, consumers are expected to see price increases within five to eight months. Marketers in this sector must navigate these challenges by emphasizing quality, innovation, and financing options to offset higher sticker prices.

Healthcare and Pharmaceuticals

Healthcare is another industry facing direct cost increases due to tariffs on imported drugs and medical devices. These impacts will likely emerge over the medium term (five to eight months) as existing inventories are depleted. For healthcare marketers, balancing price transparency with messaging around accessibility will be essential to maintaining trust in an already scrutinized sector.

Technology and Electronics

Technology companies are among the first to feel the effects of tariffs due to their reliance on global supply chains for components like semiconductors. Price increases for consumer electronics such as smartphones and laptops are expected within the first four months. Marketers in this industry should focus on communicating product value while exploring ways to offset price sensitivity through promotions or bundling strategies.

Food and Beverage (Including QSR)

While food prices are not directly impacted by tariffs in most cases, the industry feels significant indirect effects from inflationary pressures caused by broader economic disruptions. Quick-service restaurants (QSRs), in particular, are vulnerable as consumers cut back on discretionary spending. These impacts will likely emerge quickly (0–4 months), prompting marketers to emphasize affordability through value menus or loyalty programs.

Travel, Hospitality, and Leisure

The travel industry faces indirect impacts from reduced discretionary spending as consumers prioritize essential purchases over experiences like vacations or dining out. These effects are expected to materialize over the medium term (five to eight months). For marketers in this space, maintaining brand awareness while emphasizing value-driven experiences will be key to weathering this period.

Financial Services

Financial services face minimal direct exposure to tariffs but may experience secondary effects from an economic slowdown over the long term (nine months or more). For financial marketers, this period presents an opportunity to position their brands as stable partners during uncertain times while offering solutions that help consumers manage tighter budgets.

Home Improvement and Durables

The home improvement sector will feel indirect effects from higher costs for imported construction materials like steel and aluminum. These impacts are expected over the medium term (five to eight months) as project costs rise and consumer demand slows. Marketers should focus on promoting DIY solutions or smaller-scale projects that align with tighter budgets.

Media and Entertainment

Media and entertainment face low direct impact from tariffs but could see long-term effects if consumers reduce discretionary spending on subscriptions or ticketed events. Marketers in this space should focus on delivering value-driven content that resonates with budget-conscious audiences.

Timing of Tariff Impact Across Industries

The timing of tariff impact varies by industries:

- Short-term (0–4 months): Retail/E-commerce, CPG, Technology/Electronics, Food/Beverage/QSR.

- Medium-term (5–8 months): Automotive/Transportation, Healthcare/Pharmaceuticals, Travel/Hospitality/Leisure, Home Improvement/Durables.

- Long-term (9+ months): Financial Services, Media/Entertainment.

Understanding these timelines allows CMOs to anticipate challenges before they arise and adapt their strategies accordingly.

Marketers must navigate several challenges during this period of economic uncertainty:

- Short-term: Managing price increases without alienating customers; communicating transparently about tariff-related cost impacts.

- Medium-term: Adapting messaging as consumer spending shifts; balancing profit margins against competitive pricing pressures.

- Long-term: Preparing for structural market changes; sustaining brand loyalty amid prolonged economic uncertainty.

Actionable Strategies for CMOs

As CMOs and marketers pull together action plans on how to respond and be prepared for the tariffs, there are some specific things they can do, based on the category they operate in and based on the type of anticipated impact the tariff will have.

Industries such as Retail and E-Commerce, CPG, Automotive, Healthcare, and Technology face direct cost increases due to tariffs on imported goods and materials. CMOs in these sectors must proactively address price sensitivity while maintaining customer trust.

- Transparent Communication:

- Clearly explain price changes to customers, emphasizing the external factors driving these adjustments (e.g., tariffs).

- Use storytelling to highlight the brand’s commitment to quality and value despite these challenges.

- Domestic Production Narratives:

- Leverage patriotic messaging around “Made in America” products to build trust and resonate with consumers during economic uncertainty.

- Showcase efforts to support local suppliers or reduce reliance on imported goods.

- Value-Driven Campaigns:

- Focus marketing efforts on high-margin products or services less affected by tariffs.

- Bundle products or services to create perceived value and offset price increases.

- Customer Retention Strategies:

- Implement loyalty programs that reward repeat purchases, helping retain customers even as prices rise.

- Offer flexible payment options (e.g., financing plans) for higher-ticket items like electronics or vehicles.

Industries such as Food and Beverage (Including QSR), Travel, Hospitality, and Leisure, and Home Improvement are primarily affected by inflationary pressures and shifting consumer priorities rather than direct tariff costs. Marketers in these sectors should focus on affordability and adapting to changing behaviors.

- Affordability Messaging:

- Highlight budget-friendly options such as value menus (QSR) or DIY solutions (Home Improvement).

- Position products or services as “smart choices” for consumers looking to save money without compromising quality.

- Promotions and Discounts:

- Run targeted promotions during peak spending periods (e.g., holidays) to capture price-sensitive consumers.

- Offer tiered pricing models to appeal to both budget-conscious and premium customers.

- Data-Driven Insights:

- Use analytics tools to monitor shifting consumer behaviors and identify emerging trends (e.g., preferences for smaller-scale travel experiences).

- Test messaging variations across digital channels to determine what resonates most with current sentiment.

- Community Engagement:

- Build goodwill by supporting local communities through partnerships, sponsorships, or charitable initiatives tied to economic recovery efforts.

Industries such as Financial Services and Media & Entertainment face minimal direct exposure but may experience secondary effects from broader economic conditions such as reduced discretionary spending or slower investment growth.

- Positioning as Stable Alternatives:

- Emphasize the brand’s stability during uncertain times, reassuring customers that they can rely on your services or offerings regardless of market volatility.

- Educational Content Marketing:

- Create content that helps consumers navigate financial uncertainty (e.g., budgeting tips, investment strategies).

- For entertainment brands, focus on delivering escapism or value-driven content that resonates with audiences seeking affordable leisure activities.

- Long-Term Brand Building:

- Maintain marketing presence while competitors pull back due to budget constraints, ensuring your brand remains top-of-mind when spending rebounds.

- Subscription Retention Strategies:

- For streaming platforms or subscription-based services, introduce flexible pricing tiers or temporary discounts to retain subscribers facing tighter budgets.

By tailoring strategies to their specific impact levels, CMOs can mitigate risks while seizing opportunities created by shifting consumer behaviors in response to tariffs. Whether facing direct cost increases, indirect pressures, or minimal exposure, marketers must prioritize transparency, adaptability, and customer-centric approaches to navigate this challenging landscape successfully.

Resilience Requires a Plan

Want to explore what this means for your brand? Connect with Austin Wright at austin.wright@tandemtheory.com or reach us at hello@tandemtheory.com.

Common Questions:

What are the 2025 tariffs?

The 2025 U.S. tariffs include a 10% universal tariff and additional targeted tariffs, reshaping costs for imports and business operations.

Which industries are most affected by the tariffs?

Retail, CPG, technology, automotive, and healthcare sectors are among the most impacted, with timing of effects ranging from immediate to long-term.

How should marketers respond to economic uncertainty?

By focusing on value, transparent messaging, customer loyalty, and data-driven insights to adapt strategies based on shifting consumer behaviors.

What does “value-driven marketing” mean in 2025?

It means aligning your brand with what matters most to consumers now: trust, transparency, and tangible benefits that offset higher prices.